Expert Guidance for SBA Acquisition Loans

Our step-by-step guidance through the complex SBA loan process significantly increases your chances of closing. We match you with the right SBA lenders and provide expert support at every stage — free to you.

We work with over 20 of the top SBA acquisition lenders to ensure you get the best possible terms for your business purchase.

Minimum Requirements:

$250,000 loan size • $20,000 down payment

Ace CPAs, Inc is not a lender. We do not make loans. We do not make credit decisions in connection with loans. We are not an agent of either you or any lender or service provider. We may be compensated by the lender, service provider, or other third party you are connected with.

We are not affiliated in any way with the Small Business Administration or the federal government. The name is an abbreviation for Small Business Acquisition Loan Advantage, a service mark of Ace CPAs.

The Advantages of Getting Prequalified

Getting prequalified for an SBA acquisition loan gives you a significant edge in the business buying process:

Team members

Meet the talented team

behind our services

With a passion for innovation we bring diverse expertise to every project.

Mubarak Shah, CPA

USA M&A & Tax Partner

- Phone:+1 (516) 417-4941

- Email:mubarak@dealmaven.io

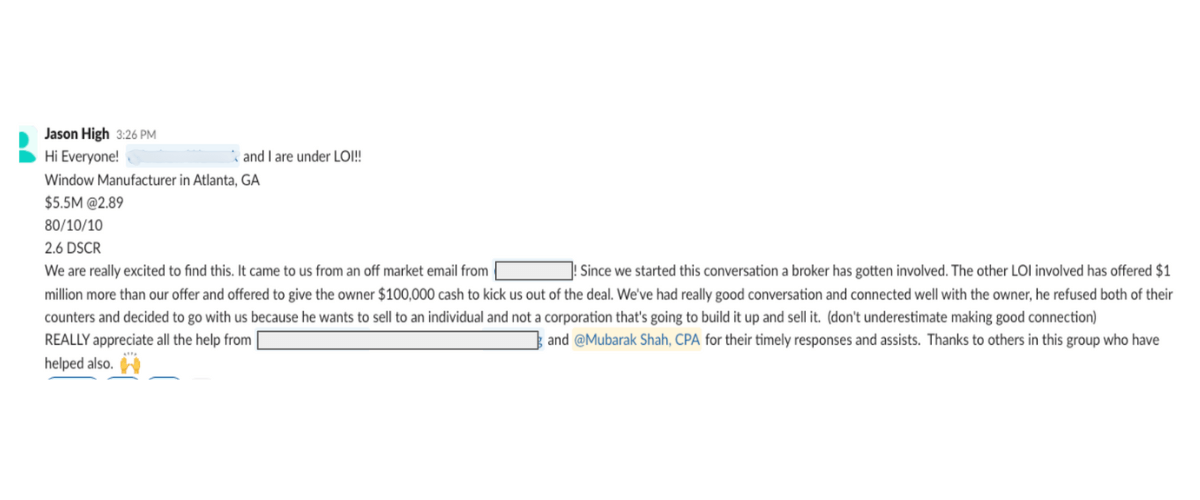

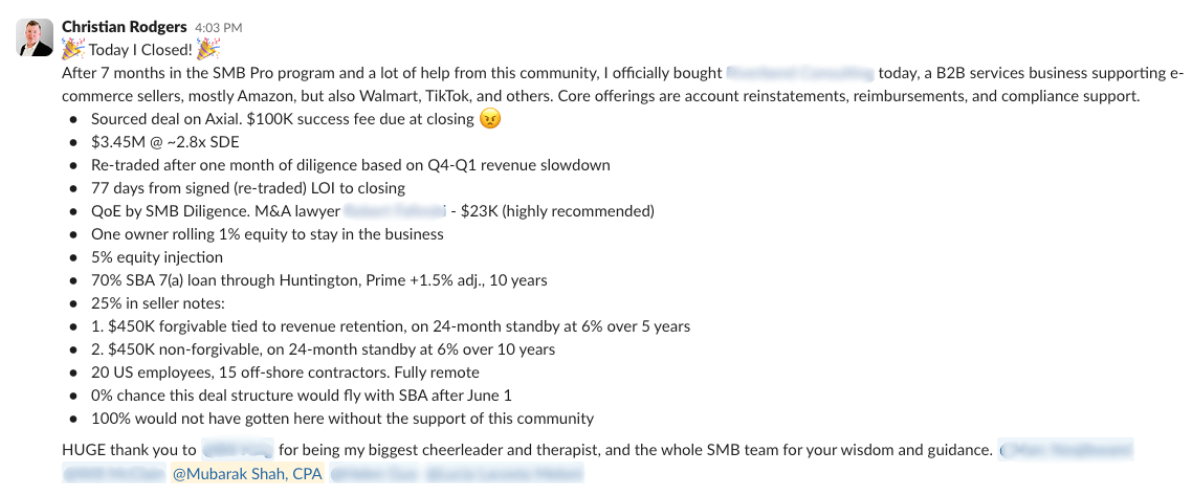

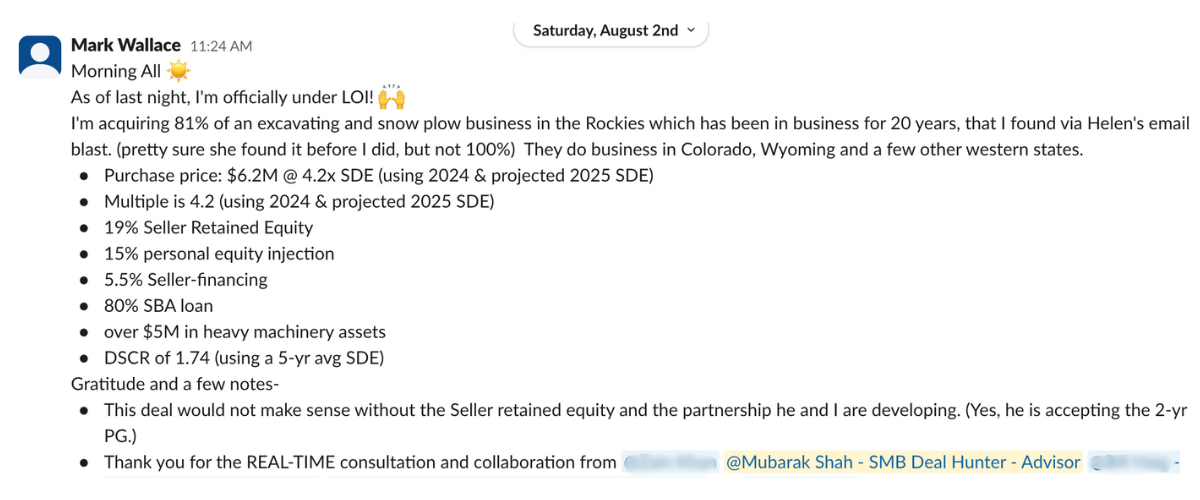

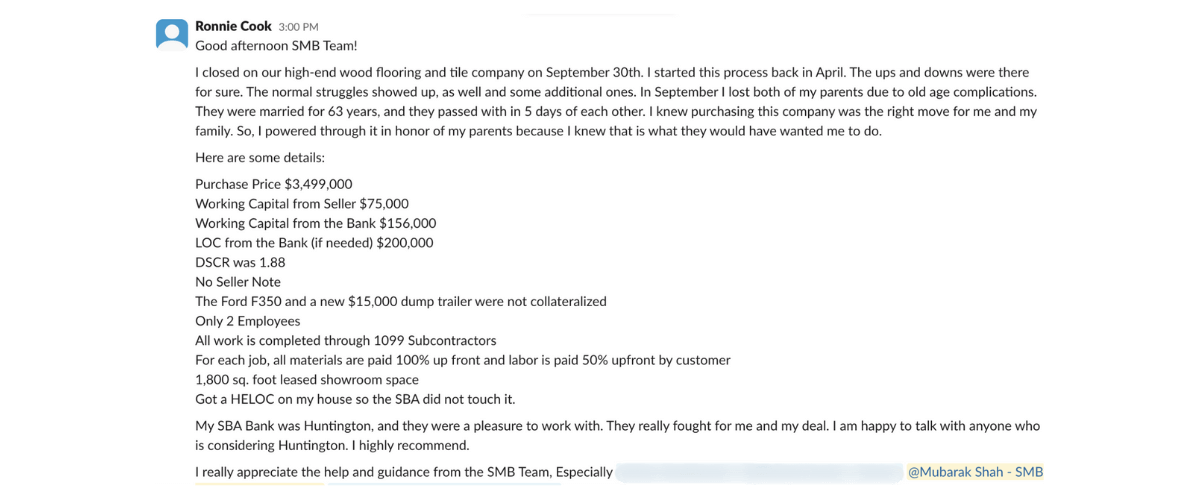

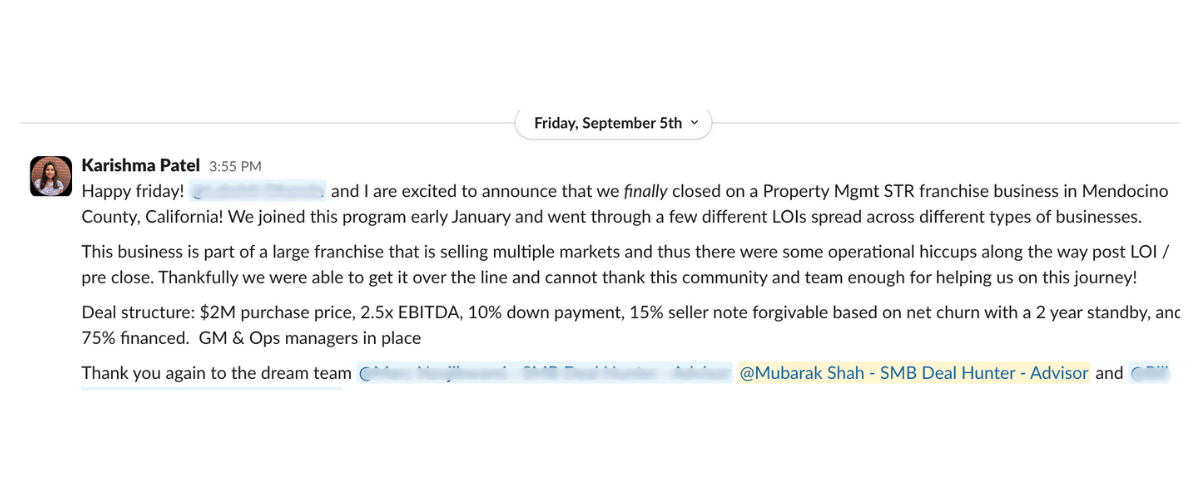

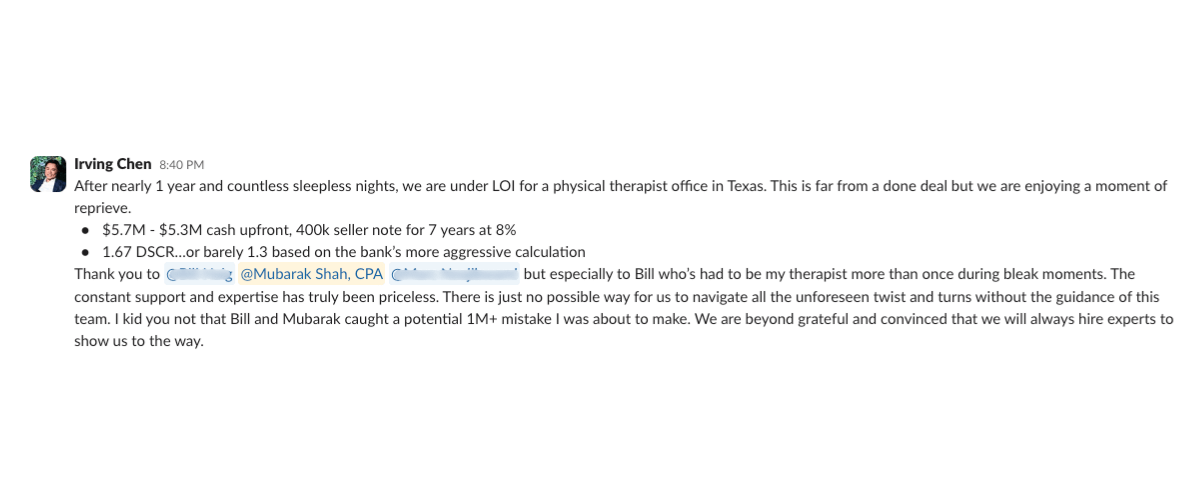

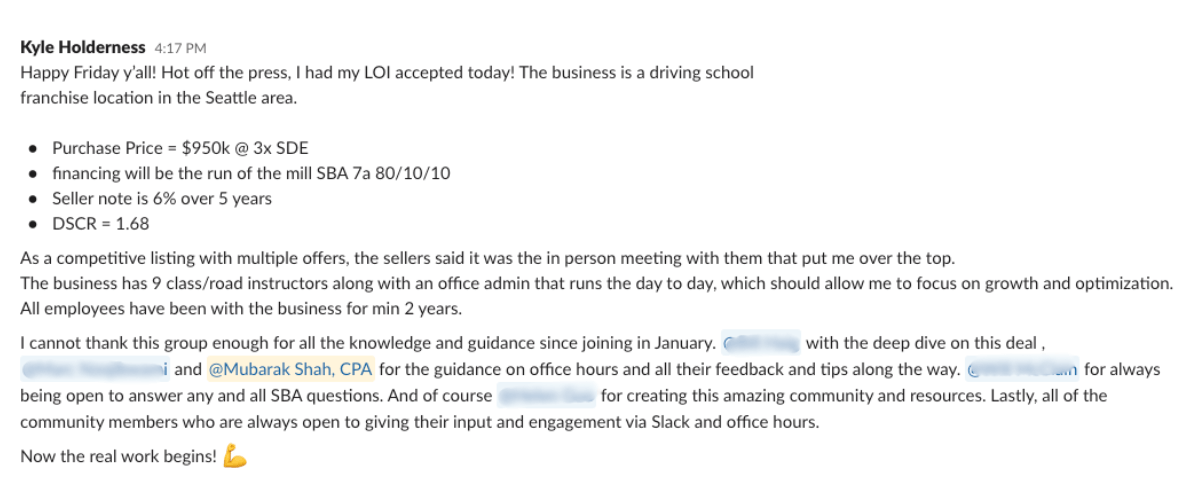

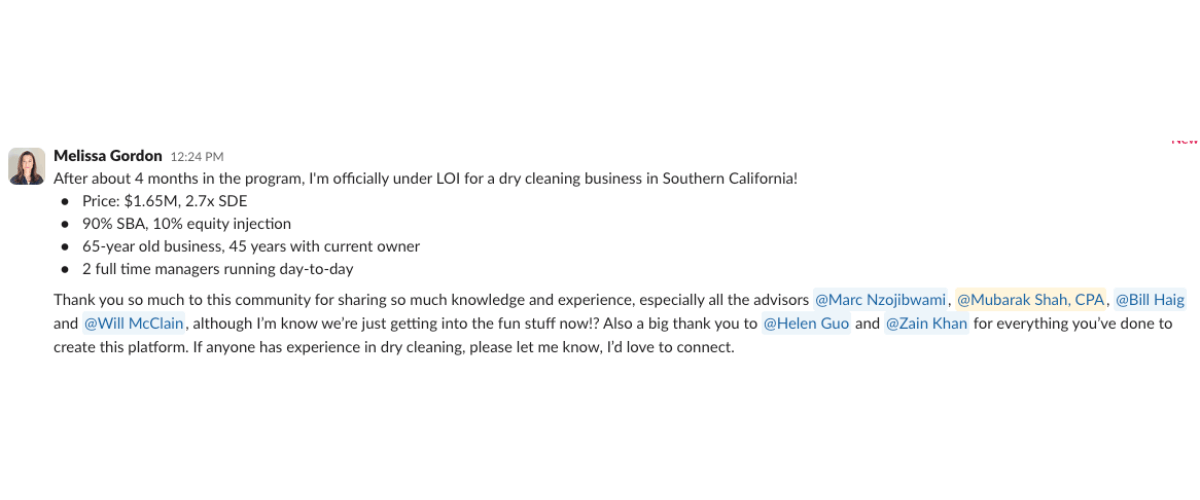

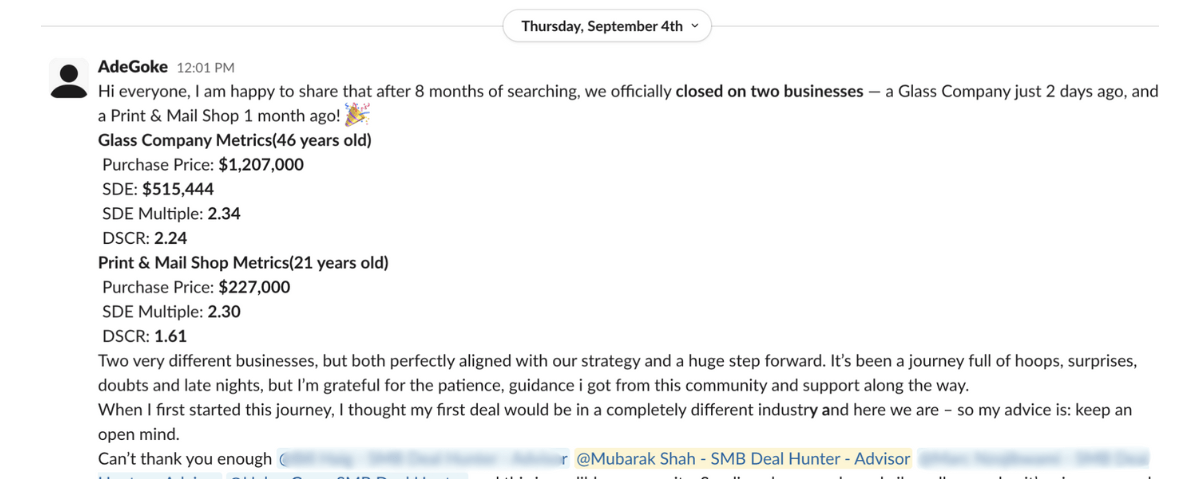

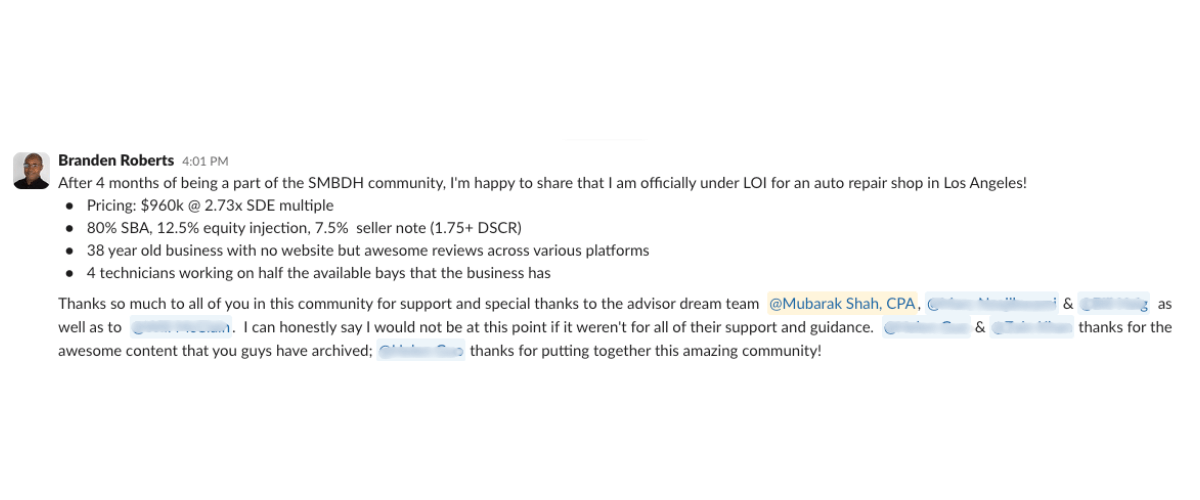

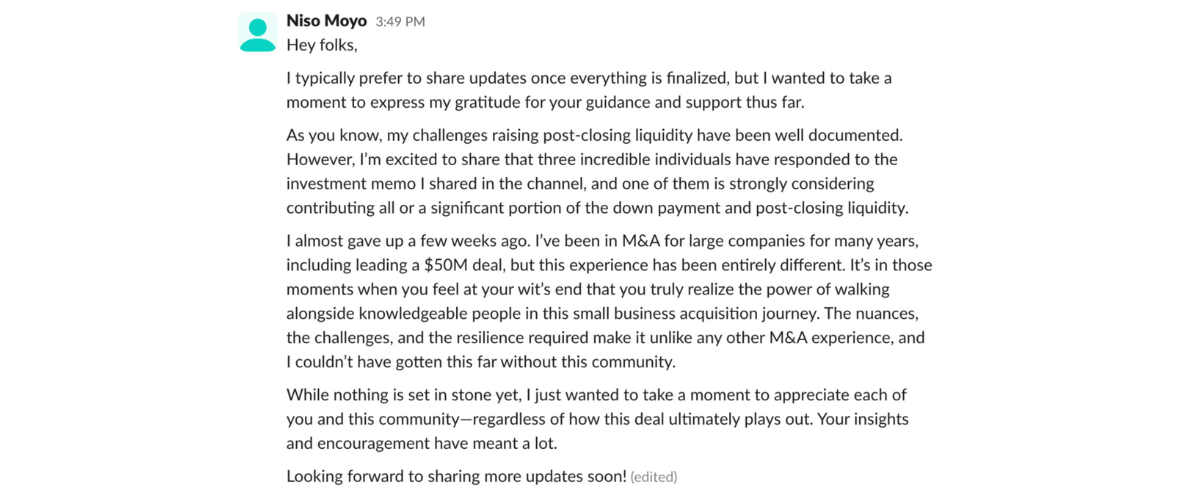

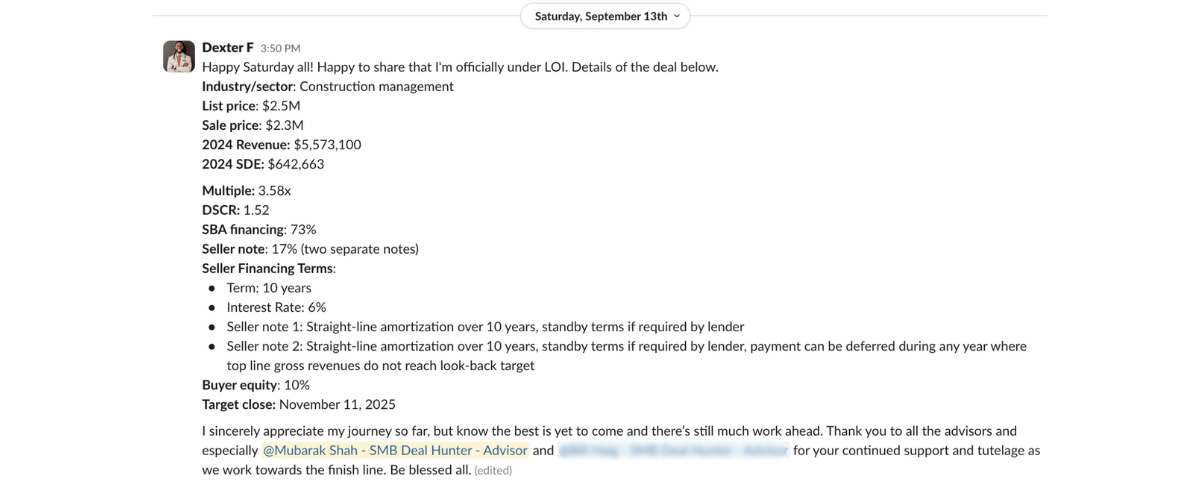

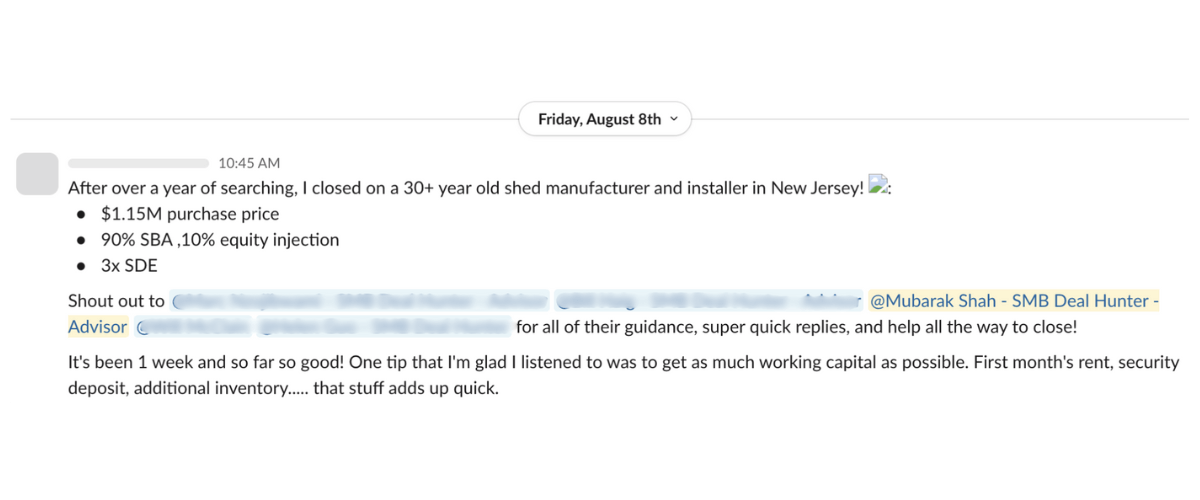

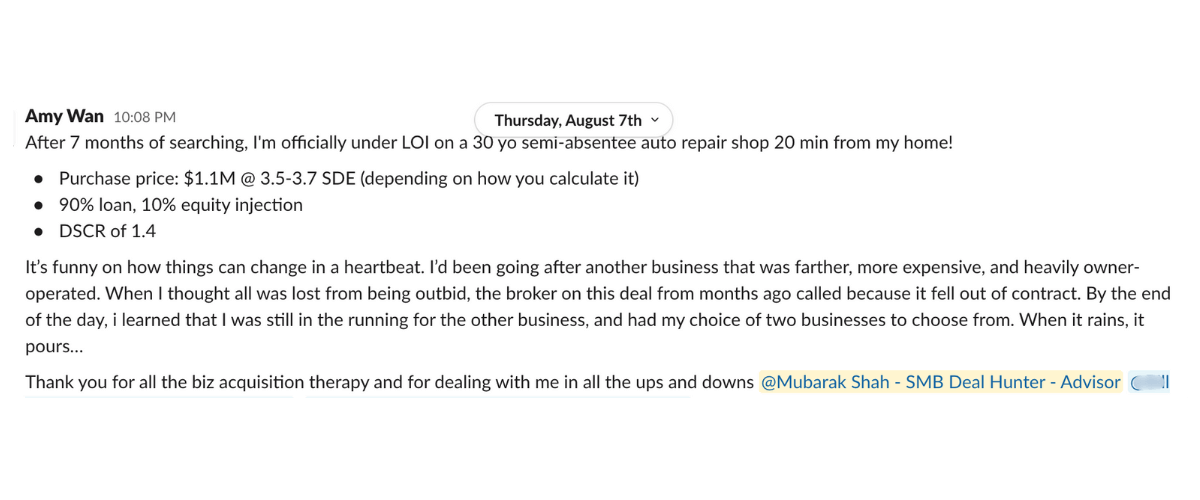

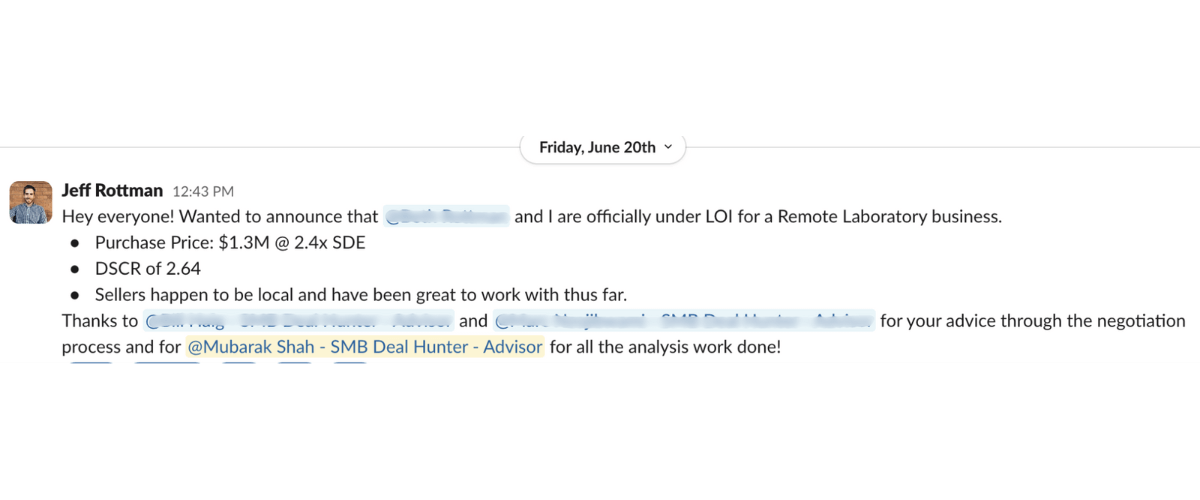

Our Proven Process Gets Results

Our expert guidance throughout the SBA loan process has helped hundreds of business buyers close deals with better terms:

Specialized in SBA

acquisition loans

- Specialized in SBA acquisition loans

- Deep understanding of lender requirements

- Expert guidance through the entire process

- Proven track record of success

- Completely free service for borrowers

How Our Guidance Works

Our step-by-step guidance has dramatically increased success rates for SBA acquisition loans

Why Our Guidance Makes the Difference

Why Choose Us

No Cost to You

Our services are free to you. We're compensated by the lenders, so there's no cost to you for our expert guidance.

Acquisition Loan Experts

Our team specializes exclusively in SBA acquisition loans, understanding the unique requirements and challenges of business purchase financing.

Extensive Lender Network

With connections to over 20 of the top SBA acquisition lenders, we match you with the perfect lender for your specific business purchase needs.

Client Experience

Tailored Solutions That

Grow With You

As a small team with big ambitions, we needed accounting support that could adapt as we scaled. AceCPAs provided exactly that flexible, reliable, and perfectly suited to our evolving needs.

My CPA at AceCPAs transformed how I price my jobs. Before, I was guessing costs and hoping for profits. Now, we have detailed job costing and profitability reports. I’m pricing smarter, bidding more competitively, and actually growing profitably. It completely changed my outlook on my business.

— Rick D. Custom Home Remodeling, Sacramento, CAI was amazed at how much money I was leaving on the table until Mubarak Shah (CPA) stepped in. They restructured our tax planning, identified deductions via Section 179 deductions and bonus depreciation we had overlooked for years, and literally saved us tens of thousands of dollars in tax season. It’s like finding hidden money every year.

— Laura G. Commercial Contractor, Nashville, TNWorking with our bookkeeper at AceCPAs has changed everything. We went from barely knowing if jobs were profitable to having weekly financial dashboards and monthly financial meetings. Every decision I make is now informed by accurate numbers, giving me complete confidence to grow faster.

— Steve P. Roofing and Exterior Services, Phoenix, AZBefore, my weekends were consumed with paperwork and chasing invoices. Now, my accountant at AceCPAs handles everything from bookkeeping to taxes. I actually have weekends off and can enjoy time with family. It’s not just money saved; it’s given me back my life.

— Mark S. Excavation & Site Preparation, Seattle, WAAce CPAs set up our accounts payable and receivable processes, and it was revolutionary. Vendors get paid on time, customers pay faster, and the visibility into our finances is unmatched. Our business feels professional, organized, and in control.

— Sandra H. Custom Home Builder, Raleigh, NCSince hiring AceCPAs firm, my confidence in running my business has skyrocketed. They proactively manage our finances, advise me strategically, and ensure we’re always in compliance. Our company grew 35% last year, and it’s largely because of their financial expertise and support.

— Tony M. Concrete & Masonry Contractor, Austin, TX

Before working with Ace CPAs, I constantly lost sleep worrying about payroll and managing cash flow. My accountant organized my books, streamlined billing and payments, and for the first time, I have clear visibility into my cash. They’ve freed up so much of my time—I’m finally focusing on building my business, not drowning in paperwork.

— John K. Residential Home Builder, Dallas, TX