Quality of Earnings

Premium Quality of Earnings Reports for In-Depth Financial Due Diligence

You've done the impossible - getting a deal under LOI! (or are on the verge of doing so). Let us help you secure your future by confirming the financials and diving into the true cash flows, EBITDA, and working capital analysis.

Our Service Offerings

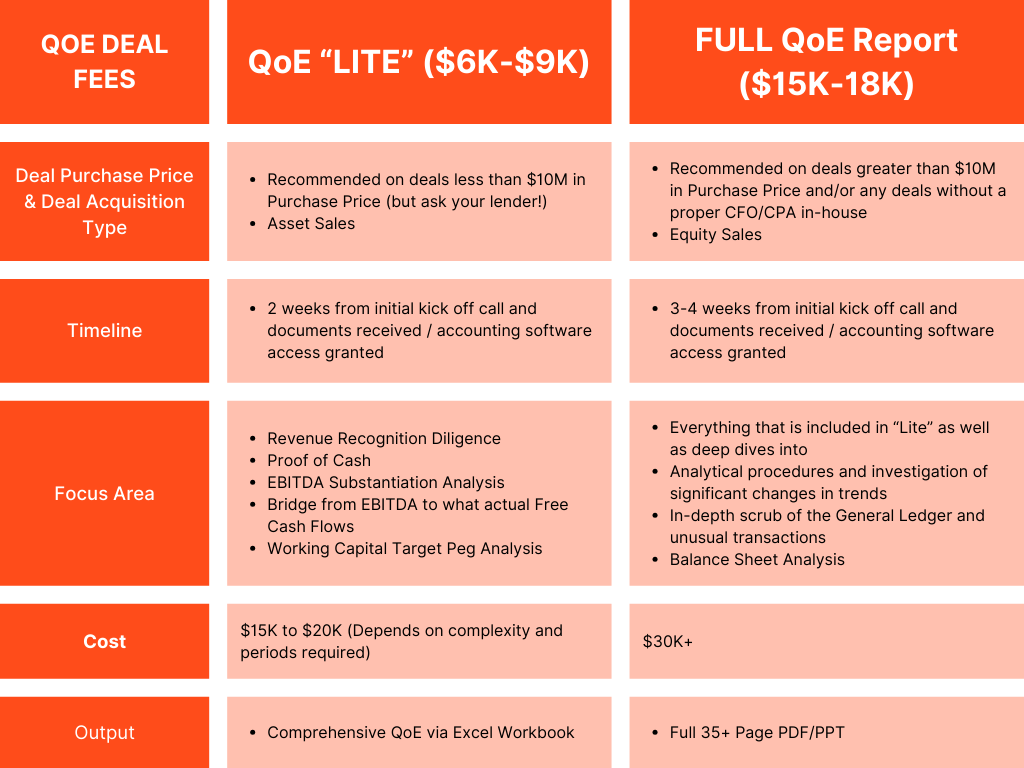

Quality of Earnings: Lite vs. Full

We offer two primary options in order to fit your needs depending on your deal size, type, and budget

(don't worry, you don't pay until you close!)

Expertise

Expertise in QoE

Strategic Financial Clarity

Our QoE reports offer an unparalleled depth of analysis, providing a crystal-clear view of a company's true financial position and future earnings potential.

Sophisticated Risk Assessment

Our thorough due diligence process employs advanced methodologies to uncover and quantify potential risks, safeguarding your interests throughout the M&A journey.

Bespoke Industry Insights

Leverage our team's deep industry-specific knowledge for tailored analyses that address the unique challenges and opportunities in your sector.

Profits Analysis

We analyze true, pro-form profits to help you understand the financial health of your target business.

EBITDA Evaluation

Our detailed EBITDA evaluations reveal the earnings potential of the business.

FCF Analysis

We provide a thorough analysis of free cash flow to assess the liquidity of your potential acquisition.

Working Capital Requirements

Understand the working capital needs to ensure smooth operations post-acquisition.

Financial Stability

We evaluate the financial stability to forecast long-term success.

Premium Services

Our Premium Services

Our Premium Services include:

Comprehensive Quality of Earnings (QoE) Reports

Advanced Financial Due Diligence

Strategic Tax Due Diligence and Planning

In-depth Operational Due Diligence

Customized Post-Acquisition Integration Strategies

Executive Dashboard Development for Real-time Financial Insights

High Level Summary Of

Key Responsibilities

FINANCIAL DILIGENCE

- QofE – Identification of historical earnings and other pro forma adjustments to consider within projections

- Inclusive of full revenue cash proof procedures

- Multi-year income statement and balance sheet quality and trend analysis

- Evaluation of working capital trends and requirements

- Identification of liabilities and potential off balance sheet exposures

- Immediate communication of potential concerns

OPS & VALUE CREATION

- Assessment of valuation estimates and key assumptions

- SWOT analysis by business function and

quantification of assessments - Operational bottleneck analysis to

identify growth capital requirements - Scoring Customer/Relationship Portfolio Sustainability and Volatility

- Cost-out identification

- Systems, Process, and Human Capital alignment with growth expectations

SUPPORT & POST-TRANSACTION

- Senior stakeholder engagement,

including regular updates to senior

executives and presenting to key

personnel - M&A data room preparation

- Post-transaction integration and value

capture execution support; program

design, management, monitoring,

measurement and reporting - Gap staffing; short-term executive and

managerial support as needed End-to-End Project / Program Management

Diligence Services and Scoping

We offer a modular approach to deal scoping. This approach allows our clients to tailor our diligence efforts to the needs of the deal.

DEAL SPECIFIC ADD-ONS (examples shown, priced by deal)

Ops bottleneck assessment

Value opportunity deep-dive

Competitive assessment

SWOT analysis by function

Post-acquisition integration & process standardization

Systems made fit for growth

Team assessment, gap analysis, and interim leadership where and when needed

ROBUST FINANCIAL DILIGENCE ($15-20K fixed fee)

- Valuation estimate and key assumptions analysis

- Micro and macro-industry and available market considerations

- Data room preparation

- External advisor coordination (e.g., counsel, tax)

CORE FINANCIAL DILIGENCE ($6-15K fixed fee)

- QofE (Including “QofE lite” for smaller transactions)

- Working capital reviews

- Cost-out Identification

- Initial team assessment

- Senior stakeholder recommendations and communication

Unparalleled Expertise in QoE and Due Diligence

In the high-stakes world of mergers and acquisitions, precision and insight are paramount. Our elite team of CPAs and financial analysts delivers meticulously crafted Quality of Earnings reports and comprehensive due diligence services, empowering both discerning buyers and sellers to navigate complex transactions with confidence.